The second edition of the Finance in Common Summit (FiCS) will focus on the role of PDBs in reconciling short-term responses to the pandemic with longer-term measures for economic recovery and the mobilization of financial resources towards the implementation of the Paris Agreement on climate change and the 2030 Agenda for Sustainable Development.

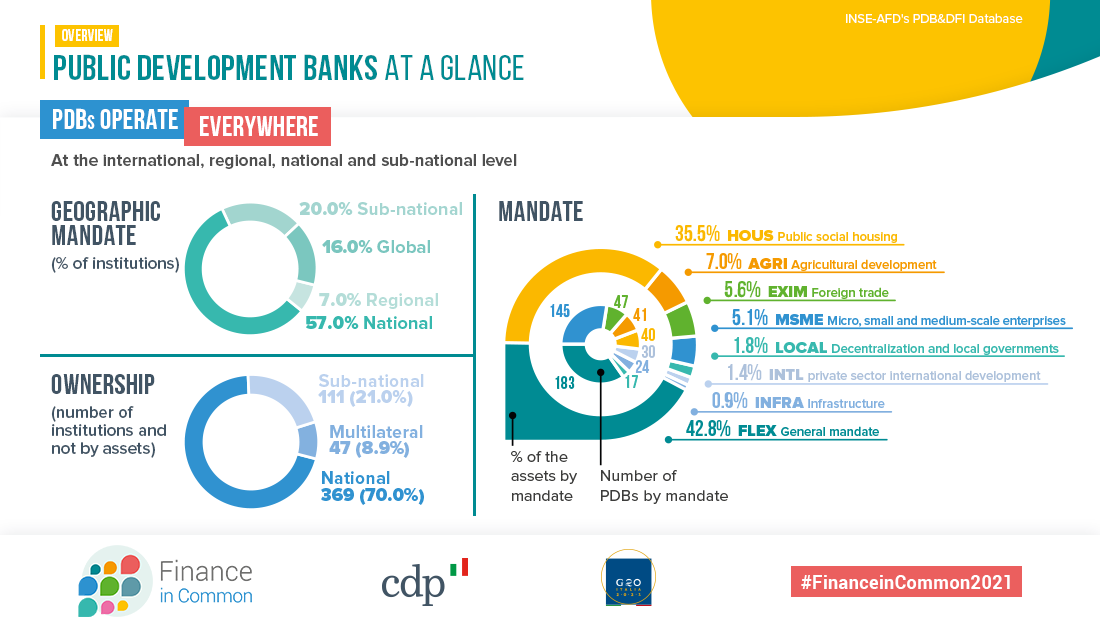

In the approach to next week’s summit, we take a glance at the role of public development banks, the scale of their investment and the ways in which they co-operate at the regional, national and international levels.

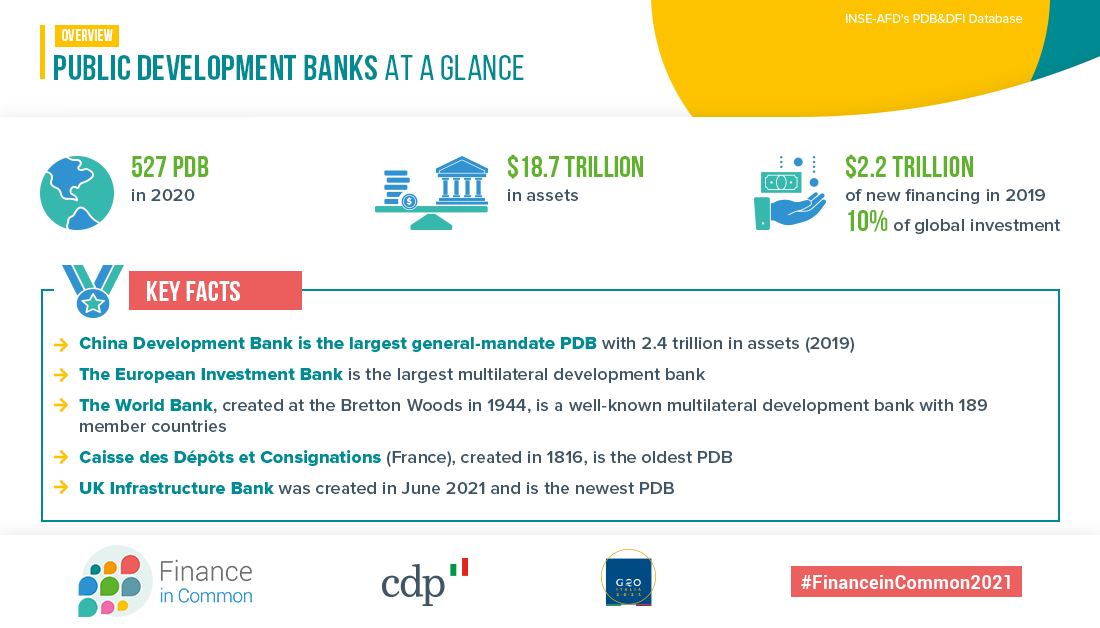

In matters of such a vast, planetary scale, few financial institutions are better placed to act than public development banks, which together invest close to 10% of global annual investments.

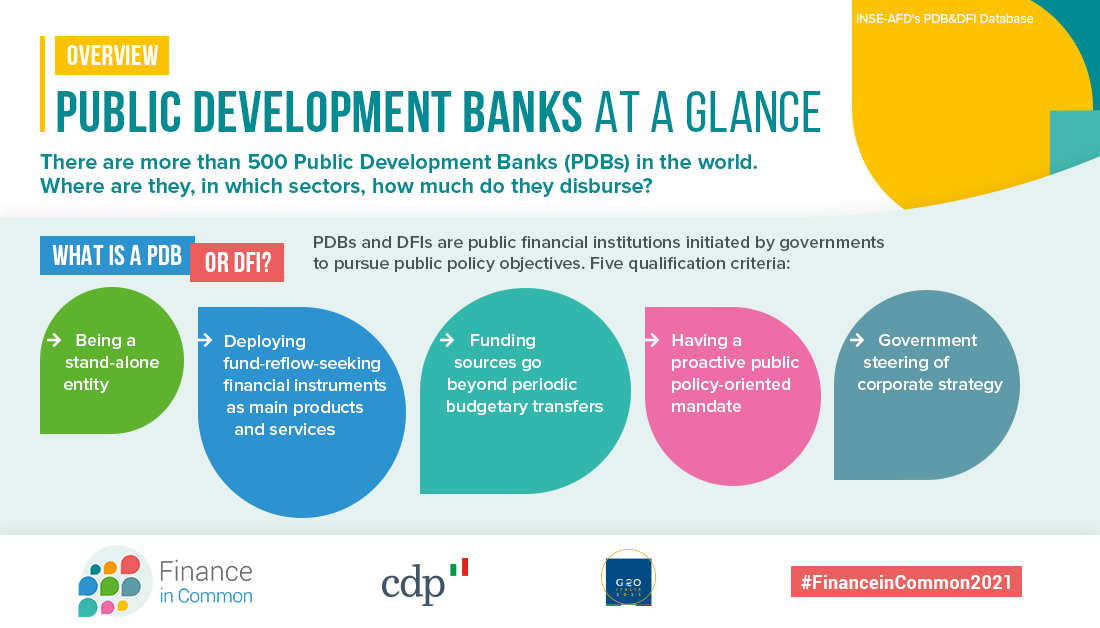

To better understand their sheer financial firepower, AFD and Peking University's Institute of New Structural Economics (INSE) launched last year the first database of the more than 500 public development banks, responsible for more than $2 trillion worth of investments in 2019.

Now updated, the database and a brand-new data visualization website will be unveiled at the FiCS 2nd edition on October 20.

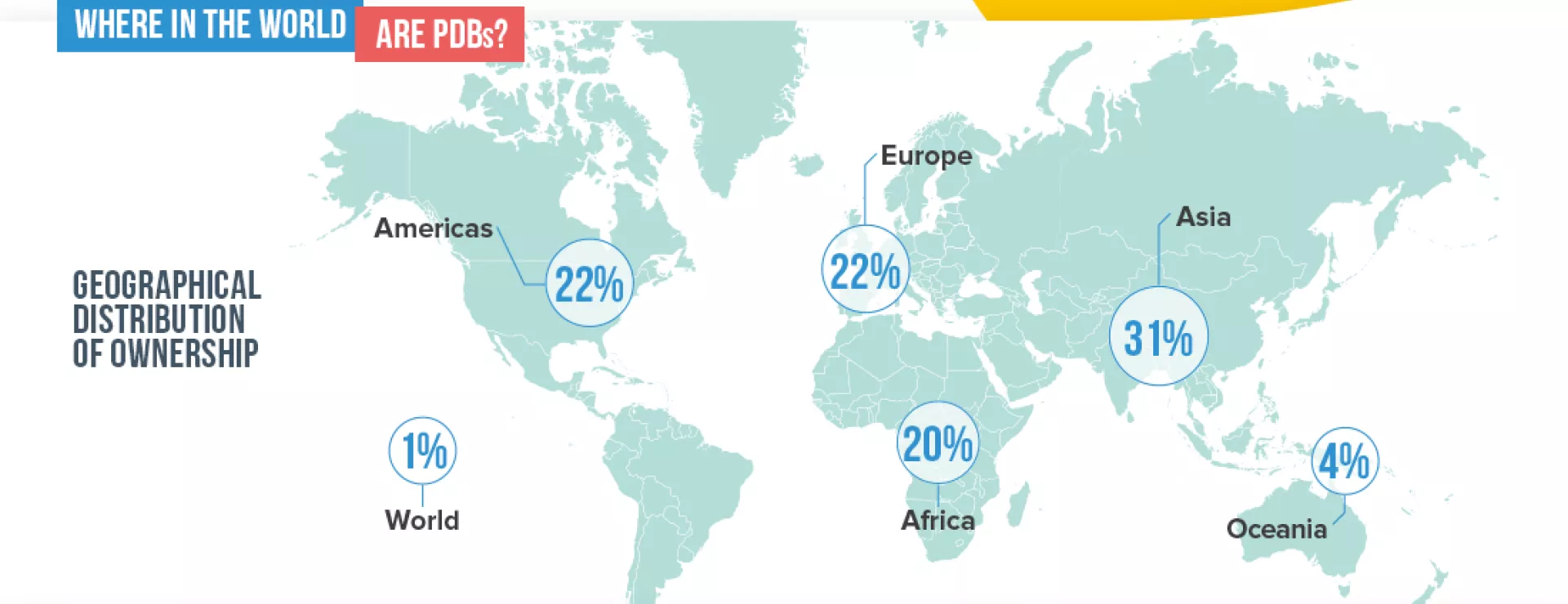

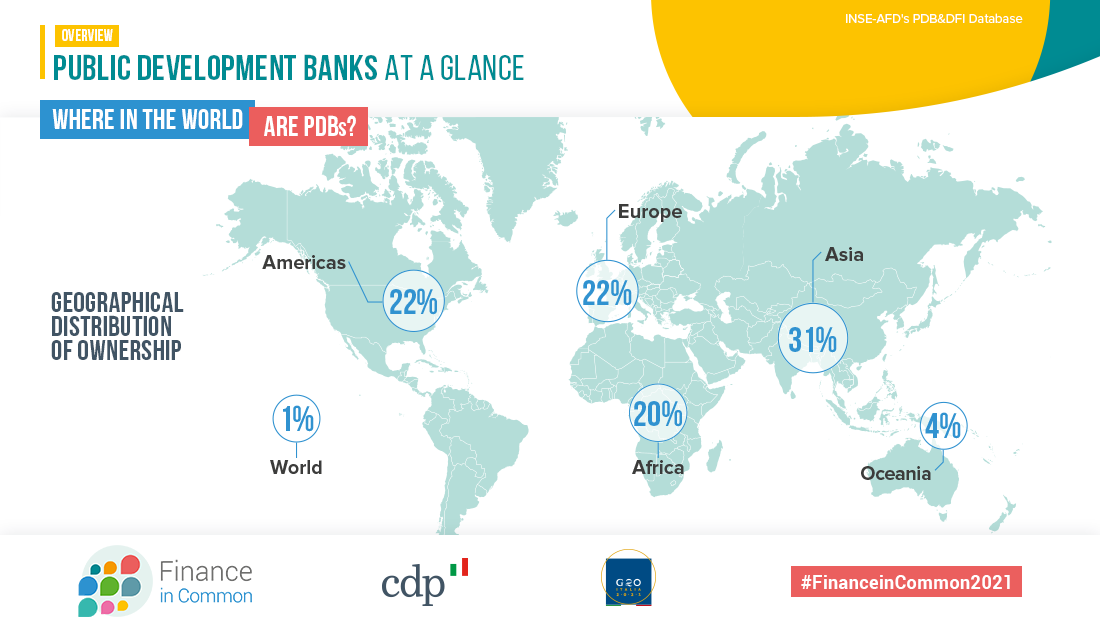

As we see below, public development banks can be found around the world. In the coming days, we will continue to look at their role, the scale of their investment and the ways in which they co-operate at the regional, national and international levels.