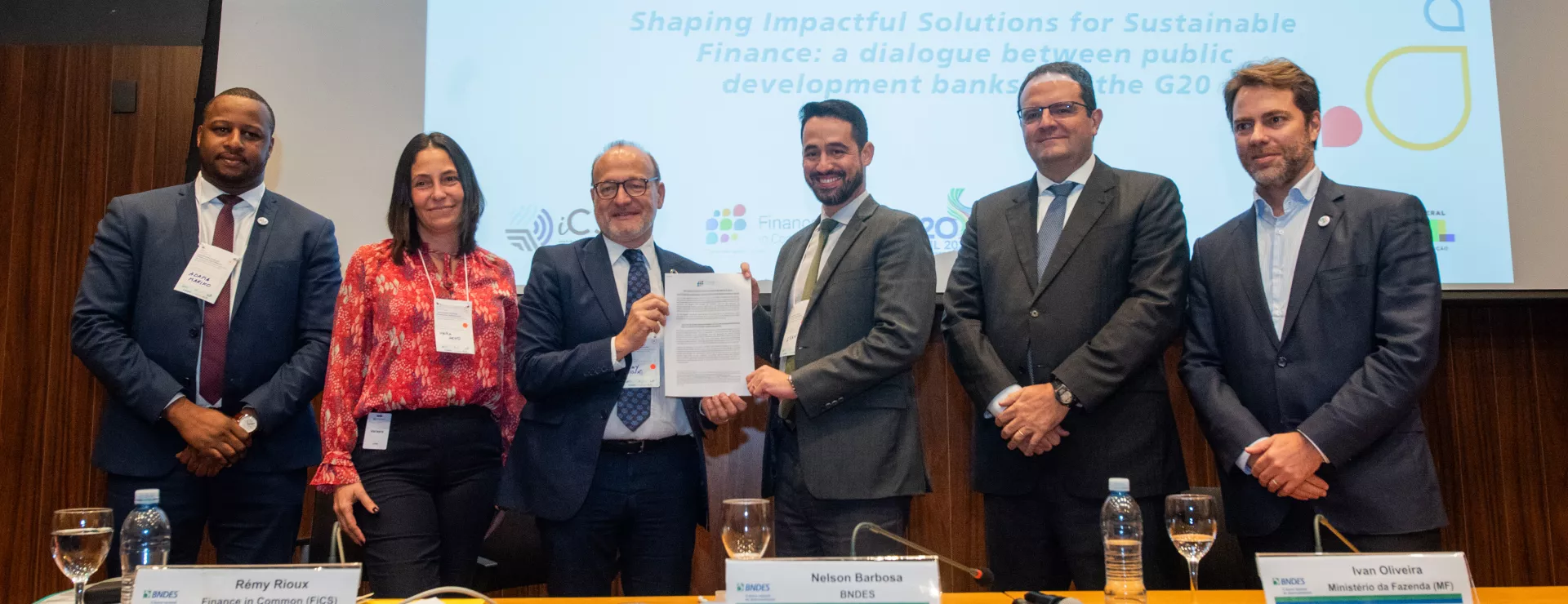

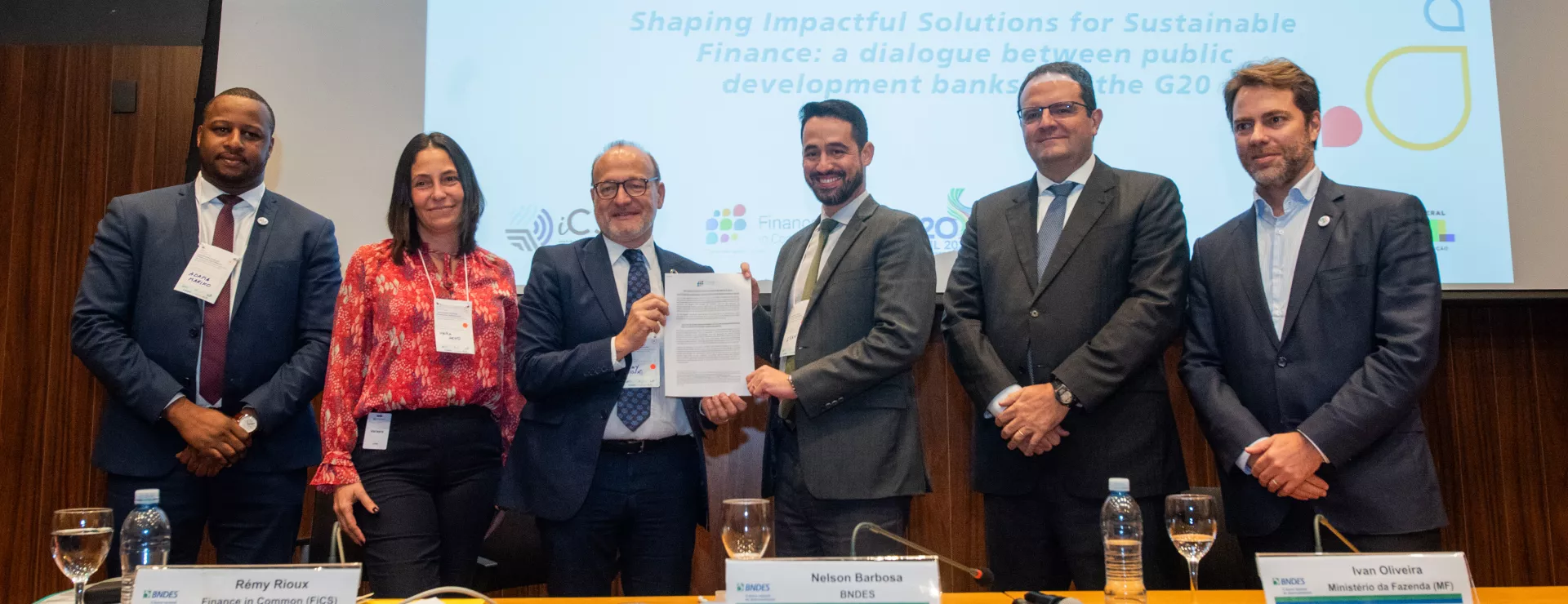

G20 Finance in Common (FiCS) Joint Event 20 & 21 May 2024, Rio de Janeiro

Solutions being deployed by FiCS:

o Sustainability focus: PDBs, with assets around USD 23 trillion, are essential in reorienting finance towards sustainability and supporting the Paris Agreement and Agenda 2030.

o Countercyclical Impact: PDBs can counteract economic downturns and bridge gaps between public mandates and private sector engagement.

o Taxonomies: to better measure the impact of what we do for the countries and global public goods

o Inclusion of all PDBs of all types and levels: articulation between international, regional, national and subnational development banks key to scale up sustainable finance

o Country platforms: Strengthening NDBs to ensure alignment with national priorities and enhance local ownership of development initiatives.

o Capital Adequacy and Optimization: Reviewing capital adequacy for PDBs to enhance their impact and efficiency in leveraging resources.

o Nature-Based Solutions: Emphasizing global collaboration to bridge knowledge gaps and advance nature-based innovations

o Climate Funds and Project Accreditation: Streamlining access to climate funds and supporting PDBs in meeting accreditation requirements for impactful projects, to unleash money that is already there

o Focus on the last mile: subnational financing for the SDGs (including with municipalities, regions, and other local actors)

o Green Cities Guarantee Fund: Proposing a fund to support cities in accessing finance for sustainable urban projects.

o Technical Assistance for Cities: Providing comprehensive support for cities to develop and execute sustainable finance projects. example of NUCA program

Our mobilization today in Rio de Janeiro - a city strongly committed to sustainable finance - is a testimony of our collective willingness to be useful, and share solutions and ideas that we could implement together in the future. The Brazilian Presidency of the G20 can count on our full support and willingness to make sustainability the new norm of finance.