Why finance in common?

In the context of the Covid-19 pandemic and subsequent global socio-economic crisis, the Finance in Common Summit will stress the crucial role of Public Development Banks (PDBs) in reconciling short-term countercyclical responses to the crisis with sustainable recovery measures that will have a long-term impact on the planet and societies. The Finance in Common Summit is an opportunity to:

- gather more than 500 PDBs and discuss their role, their ambition, their challenges and opportunities;

- bring together the financial community at large to design a financial system whereby Public Development banks would have the ability to reorient and leverage all financial flows in the direction of climate and the SDGs; and

- contribute to supporting and reinventing multilateralism by promoting new forms of cooperation.

The Finance in Common Summit will gather the whole Public Development Bank community along with other key stakeholders, such as Heads of State, governments, supervisors, and representatives from the private sector, civil society, think tanks and academia. By rallying and challenging a new and significant global community with enhanced capacity of action, and by promoting sustained collective action, the Finance in Common Summit seeks to contribute substantially to the success of the UNSG’s “Decade of Action”.

What are public development banks?

A Key to Delivering the Finance We Need for the Future We Want.

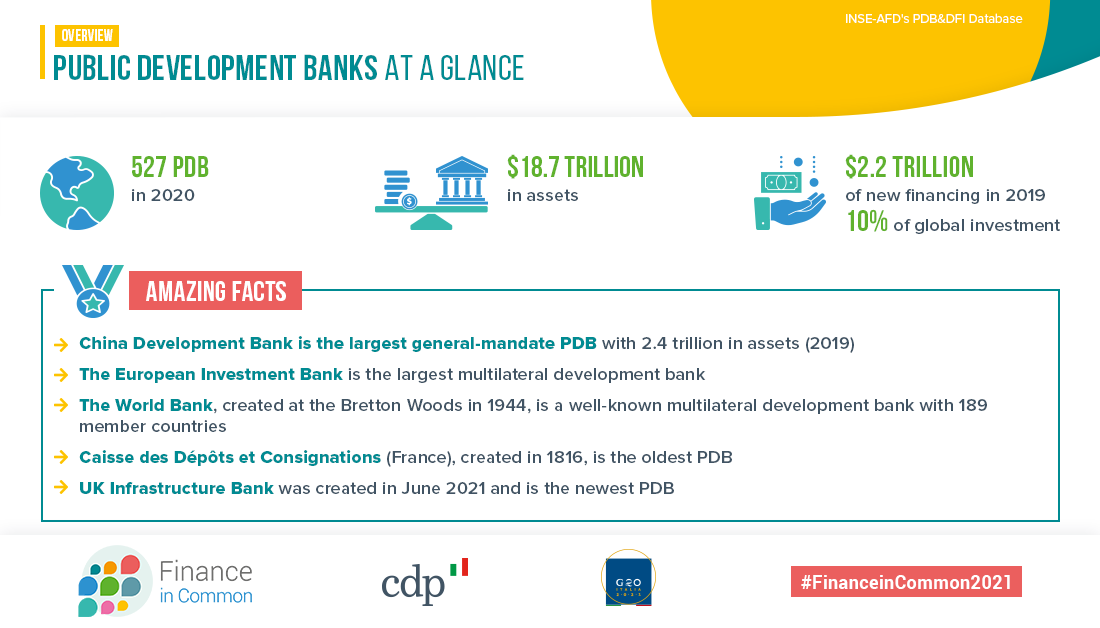

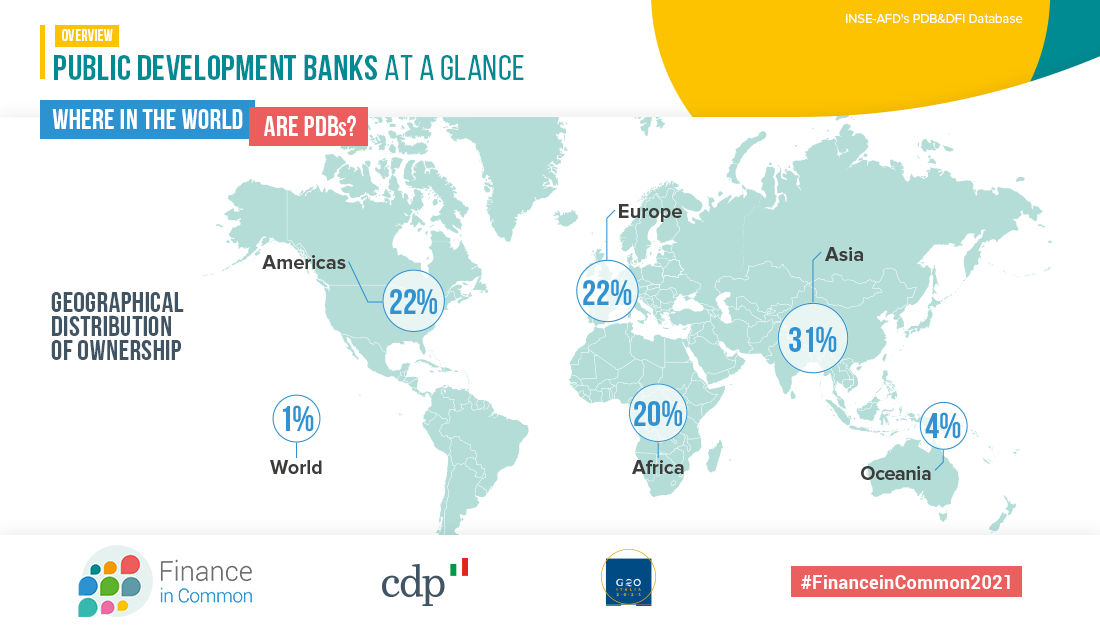

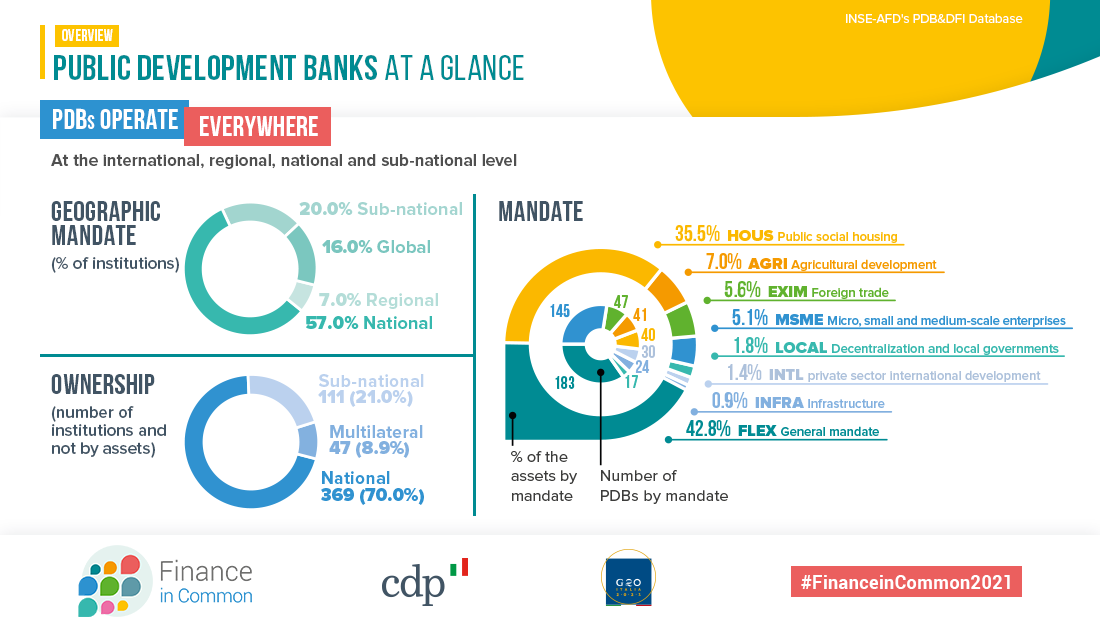

There are more than 500 Public Development Banks around the world, operating at sub-national, national, regional, international and multilateral levels. The volume of activity of these institutions amounts to about USD 2.2 trillion annually – a staggering 10 percent of the total amount invested in the world every year by all public and private sources combined.

With their public mandates and counter-cyclical roles, Public Development Banks are more relevant than ever to contribute to the reconciliation of economic recovery and sustainable development. These institutions represent a “visible hand” that can help mobilize and direct the finance we need for the future we want.

PDBs are organized by region, with deep roots in local economic and social fabrics, and with historic support from regional Multilateral Development Banks. They play a vital part among local stakeholders and can deploy a wide range of powerful instruments in order to bridge market failures, mobilize domestic resources, redirect investments, support private sector mobilization and promote sustainability. PDBs are able to deliver both the “first mile” and the “last mile” of funding, connecting policy intentions with results on the ground – before, after, or in conjunction with financial markets.

Some PDBs have already been active for decades, and an increasing number of governments are either strengthening them or establishing new ones. Their legitimacy is reinforced by a new vision of development financing – one that extends beyond the scope of infrastructure investment or other traditional mandates and that is capable of mobilizing both government institutions and financial markets. On the ground, PDBs can help deliver the institutional change and real economy outcomes that are required to turn the UN SDGs into reality. For example, their funding and advice to governments can boost investment in social infrastructure, notably for healthcare. They can also help build the confidence to achieve carbon neutrality by 2050, while increasing the use of nature-based solutions.

In a world awash with liquidities, there is an urgent need for a coalition of financial institutions able to transform public resources into concrete and sustainable projects on the ground. Such coordination among PDBs would eventually link international policy issues with local solutions, and governments’ ability to identify sustainable development trajectories with private-sector opportunities.

Public Development Banks (PDBs) are a vast family of institutions at the intersection between finance and public policy. They share four characteristics:

- They enjoy independent legal status and financial autonomy.

- They are controlled or supported by central or local governments.

- They execute a public mandate, addressing market inconsistences – notably for the financing of small and medium entreprises, essential infrastructures, local financial markets, housing, small agriculture, and regional and international trade – to the benefit of enterpreneurs, rural households, and the most vulnerable, including women and young people.

- They are not engaged in commercial banking, individual bank accounts or consumer credit.

Global problems call for global solutions

Through this new global federation, PDBs will work together, as a community and as a system with their stakeholders

- to explore their complementarities

- to make optimal use of the diversity and added value of all the different types of PDBs and networks

- to share best practices and innovation

- to build capacities and improve mutual recognition of procedures;

- to facilitate access to international concessional finance

- to accelerate the deployment of public resources as well as the mobilization of the private sector for recovery, resilience and sustainability, in their respective constituencies.

Public Development Banks will also aim at more coherence in their approaches, actions and interventions, in close collaboration with their various stakeholders, to make the whole development finance system operate more efficiently.